Business

Asda Faces Challenge to Regain Market Momentum

According to industry data, Asda’s efforts to reverse its fortunes have not prevented the company from ceding market share to its competitors.

On a drizzly midweek afternoon, the car park of Crawley's Asda supermarket is bustling with activity. Parents, laden with school bags and groceries, hurry to and from the store, while others load their weekly shopping into their vehicles.

For local resident Carol Stimpson, the Asda is a convenient 10-minute walk from her home, making it a regular destination for her daily needs. "It's essentially my local corner shop," she explains.

Fellow local Joanne Dench also frequents the Crawley Asda, drawn by its diverse range of products, including clothing and international cuisine. "I appreciate the variety they offer, and the international food selection is particularly appealing to me," she says.

Despite the steady stream of customers at this West Sussex Asda, the supermarket chain is facing significant challenges in the market.

The UK's third-largest supermarket experienced a dismal Christmas period, with two sets of industry data indicating a substantial decline in sales, while its main competitors reported increases.

According to Worldpanel, Asda's sales plummeted by 4.2% during the 12 weeks leading up to December 28, 2025, following a disappointing Christmas the previous year.

Food retail analyst William Woods of Bernstein Research characterizes Asda's situation as "a mess."

Industry data suggests that despite Asda's efforts to revamp its strategy and reduce prices, customers continue to defect to other retailers. Asda remains hopeful that its plan will ultimately bear fruit, but others are skeptical about the 60-year-old retailer's ability to recover.

For decades, Asda was renowned for its reputation as Britain's most affordable grocer, a reputation built on its "everyday low prices" and cherished by families.

A generation of consumers grew up with Asda's iconic "That's Asda Price" advertising campaign, which debuted in 1977 and featured shoppers tapping their back pockets to signify the money they had saved.

In 1999, Asda was acquired by US retail giant Walmart in a landmark deal that marked the largest foreign takeover in the UK retail sector at the time.

However, from around 2010, Asda struggled to counter the growing threat posed by discounters Aldi and Lidl, as Walmart's priorities shifted towards its US and international operations.

Asda was sold in 2021, after paying approximately £4 billion in dividend payments to Walmart over the preceding four years.

The supermarket chain was purchased by billionaire brothers Mohsin and Zuber Issa, along with private equity firm TDR Capital, in a £6.8 billion deal.

The Issa brothers, who amassed their fortune through their petrol forecourt empire EG Group, were hailed as self-made entrepreneurs poised to bring fresh perspectives to the business.

However, the acquisition was financed by loading billions of pounds of debt onto Asda's balance sheet, making it one of the largest debt-funded takeovers in recent UK history.

The deal was concluded at the end of the Covid-19 pandemic, when grocery sales were booming, but the market soon underwent a significant shift. The war in Ukraine triggered a sharp increase in inflation and interest rates, driving up the cost of Asda's borrowings.

Following the takeover, Asda's CEO departed, and Mohsin Issa assumed the role.

According to a former Asda executive, "While Mohsin Issa's instincts were sound, the business required an experienced leader to navigate the challenging circumstances."

Asda's problems intensified, exacerbated by high management turnover and shifting priorities.

Store standards declined due to staff hour reductions, leading to customer complaints about empty shelves, slow restocking, and poor online availability.

Lynette, a Swindon resident who had shopped at Asda for over 20 years, noted a significant decline in the store's quality, citing closed checkouts and empty shelves.

Having once been a loyal Asda customer, Lynette has recently begun using discounters Aldi and Lidl for her primary shopping needs.

Behind the scenes, Asda was undergoing a major technological overhaul, transitioning away from the systems it used during the Walmart era.

This included the installation of nearly 16,500 new checkouts, as well as the launch of a new groceries app and website, at a cost of hundreds of millions of pounds.

By autumn 2024, Mohsin Issa had stepped down as CEO, and TDR Capital had assumed majority ownership of the business.

According to Worldpanel, Asda's market share had fallen from 14.3% prior to the takeover to 11.4% by the end of December 2025.

This decline translates to a £4.5 billion reduction in annual revenue, based on current prices, compared to what Asda would have achieved if it had maintained its previous market share.

The grocery sector is characterized by high fixed costs and narrow profit margins, making it challenging for retailers to recover from declining sales volumes. According to Bernstein's William Woods, this can create "a negative spiral that is extremely difficult to escape."

Asda is currently in the midst of a turnaround plan, aimed at reviving its fortunes.

However, industry data suggests that the plan has yet to gain traction, raising questions about whether Asda needs more time to recover or if it will struggle to win back customers.

In an effort to revitalize the business, Asda has appointed the executive who previously helped rescue the company from the brink of collapse over 30 years ago.

Allan Leighton, who took on the role of executive chair in November 2024 at the age of 71, has unveiled a plan to revive Asda's fortunes by re-launching the Asda Rollback price campaign, which he successfully implemented in the 1990s.

The Rollback campaign involves temporary price reductions, followed by the introduction of new "Asda Price" points that are guaranteed to be lower than the original pre-Rollback prices.

Leighton aims to make Asda 5-10% cheaper than traditional supermarkets by the end of 2026, even if it means taking a short-term hit on profits.

One year after the launch of the Rollback campaign, data from retail research firm Assosia shows that Asda's prices on over 30 branded items were generally lower than those of Tesco, Sainsbury's, and Morrisons during the festive quarter.

Asda has also consistently ranked highly in a weekly price survey conducted by The Grocer magazine, which excludes Aldi and Lidl.

According to The Grocer's editor-in-chief, Adam Leyland, "Asda has indeed been 5% cheaper than its established rivals at times over the past year."

However, the price cuts do not appear to have had a significant impact on Asda's fortunes.

Leyland notes that "for shoppers, it's not just about price; customer service, in-store experience, and range are also crucial, as well as perceptions of value and brand appeal."

Madeline in Crawley is among those who have been deterred from shopping at her local Asda, citing her dissatisfaction with the store's weekly offerings.

She notes that her shopping experience is often hindered by empty shelves and obstructed aisles, which can be frustrating and ultimately drives her to shop elsewhere.

A key supplier suggests that Asda's struggles stem from its failure to strike a balance between investing in its stores and maintaining product availability, highlighting the need for the retailer to focus on the fundamentals of its business.

Asda maintains that it is making progress, having increased staff numbers in its stores, in an effort to address the issues that have driven customers away.

However, regaining customer loyalty is a challenging task, particularly in a competitive market where rivals are leveraging price matching and loyalty schemes to attract shoppers.

William Woods argues that Asda's decision to discontinue its year-long price match campaign with Aldi and Lidl in January 2025 was a mistake, citing the success of similar campaigns by Tesco and Sainsbury's in changing customer perceptions.

Woods also notes that the loyalty price schemes offered by Tesco and Sainsbury's, such as Clubcard and Nectar, create a positive experience for customers at the checkout.

Asda acknowledges that its turnaround is a long-term process, expected to take three to five years, and is focused on providing value to its customers, ensuring product availability, and delivering a positive shopping experience.

According to an Asda spokesperson, the company is in the early stages of its transformation, which is centered on offering an unmatched value proposition and ensuring that customers have a positive experience when shopping in-store or online.

The spokesperson adds that this approach is beginning to yield positive results, with stronger sales volumes reported in recent periods.

However, a source familiar with the situation notes that Asda's recovery was disrupted last summer due to the complexities of separating from Walmart's systems, resulting in empty shelves and a disappointing Christmas trading period.

The source acknowledges that the separation from Walmart was necessary, despite the challenges it presented.

Asda's sales have continued to decline, with December marking its 22nd consecutive month of decline, according to Worldpanel sales data.

Industry observers are questioning whether Asda has the resources to regain its lost market share, given its high levels of debt and the significant investment required to drive a full recovery.

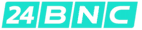

In an effort to reduce its debt, Asda sold and leased back several stores and a distribution center, resulting in a net debt of £3.8bn at the end of December 2024, with annual financing costs increasing by 38% to £611m.

A former Asda executive believes that the business is "broken" and that its high debt levels will hinder its ability to invest in the necessary changes to drive a recovery.

The executive argues that the lack of investment in the business over the past 10-15 years has contributed to its current struggles, and that the required level of investment may be unsustainable for the company.

An Asda spokesperson disagrees, stating that the company's strong balance sheet and cash flow generation enable it to meet its current and future debt obligations.

Asda is not alone in its struggles, as fellow supermarket chain Morrisons has also faced challenges under new private equity ownership, selling assets to reduce its debt and losing market share to Aldi.

A major supplier notes that both Asda and Morrisons are working to reduce their debt burdens, which are hindering their ability to compete effectively.

The supplier expresses a desire to see Asda recover, but questions whether it is feasible given the company's current situation.

Ged Futter, a former Asda buyer, now trains suppliers on how to negotiate with supermarkets and fears that his former employer is in serious trouble.

Futter cites an example of a client who was asked to invest in promotions with Asda, but declined due to the high demands being made.

This year, the price of Asda's traded debt has fallen further, indicating that investors are becoming increasingly concerned about the viability of the company's turnaround.

A person familiar with Asda's operations believes that the company has a strong offer, including its in-store pharmacies and opticians, as well as the George clothing brand and a healthy general merchandise business.

Many observers expect some form of consolidation in the supermarket sector, potentially involving mergers, sales, or break-ups.

Allan Leighton's task of turning around Asda is compared to climbing Mount Everest, highlighting the significant challenges that lie ahead.

Lynette, a Swindon local, says she will not return to shopping at Asda, having lost faith in the store.

Asda urgently needs to build momentum, and 2026 is seen as a critical year for the company's turnaround efforts.

Top image credit: Getty Images

Business

DP World CEO departs amid fallout over Epstein connections

Sultan Ahmed bin Sulayem’s departure follows the revelation of hundreds of emails allegedly exchanged between him and Epstein, as revealed in recently disclosed documents.

DP World's global ports operator has undergone a change in leadership, with the previous head stepping down amidst scrutiny surrounding their association with convicted sex offender Jeffrey Epstein.

Sultan Ahmed bin Sulayem's departure as chairman and chief executive follows the release of newly uncovered files, which indicate he exchanged numerous emails with Epstein over the course of a decade.

The mention of an individual in these files does not imply any wrongdoing, and the BBC has reached out to Sulayem for a statement regarding the matter.

On Friday, DP World announced the appointments of Essa Kazim as chairman and Yuvraj Narayan as chief executive, without making any reference to Sulayem, whose photograph appears to have been removed from the company's website.

DP World, a Dubai-owned logistics company with a significant presence in global trade infrastructure, operating port terminals across six continents, has faced increasing pressure from its business partners in recent days.

Earlier in the week, the UK development finance agency and La Caisse, Canada's second-largest pension fund, announced that they would be suspending new investments in the firm.

Additionally, the Prince of Wales' Earthshot project, which received funding from DP World, was reported to the UK Charity Commission following Sulayem's appearance in the recently released files.

The documents suggest a close and extensive relationship between Sulayem, a prominent Gulf business figure, and Epstein, spanning multiple areas of interaction.

US lawmakers Ro Khanna and Thomas Massie have accused Sulayem of being one of several influential individuals associated with Epstein, citing him as one of "six powerful men" linked to the disgraced financier.

The lawmakers, who co-sponsored the legislation that led to the release of the Epstein files last year, claim that certain information was improperly redacted from the documents.

On 9 February, Thomas Massie highlighted a redacted document that appeared to contain an email from Epstein in 2009, referencing a "torture video"; the recipient responded that they would be traveling between China and the US, although the context of the exchange is unclear.

US officials have confirmed that Sulayem was the recipient of the email in question, which was sent by Epstein.

Business

Consider Alternatives to Your Current Bank Account

According to Martin Lewis, the current moment may be an opportune time to consider switching bank accounts.

The complete episode is available for streaming on the BBC Sounds platform.

Business

Veteran Designer of Hello Kitty Retires After 46-Year Tenure

Under Yuko Yamaguchi’s guidance, the feline character achieved global icon status.

After a 46-year tenure, the creator of Hello Kitty is relinquishing her design role, marking the end of an era for the beloved character that has become a global phenomenon.

In 1980, Yuko Yamaguchi assumed design responsibilities for Hello Kitty, a character that, despite being commonly perceived as a feline, is actually a little girl from London, five years after the character's initial launch.

During Yamaguchi's four-decade stewardship, Hello Kitty has evolved into one of the most successful franchises worldwide, with its popularity extending far beyond its origins in Japan.

Sanrio, the company behind Hello Kitty, has expressed its gratitude to Yamaguchi, stating that she has "passed the torch" to the next generation of designers.

The launch of Hello Kitty coincided with the rising global popularity of Japanese 'kawaii' culture, a distinctively feminine and youthful aesthetic that has become a cultural phenomenon.

Yamaguchi often embodied the Hello Kitty spirit by wearing dresses inspired by the character and styling her hair in buns, reflecting her deep connection to the brand.

Now 70, Yamaguchi has been credited by Sanrio with transforming Hello Kitty into a universally beloved character, as noted on the company's website.

Sanrio has announced that one of its designers, known by the pseudonym "Aya", who has been working alongside Yamaguchi, will take over as the lead designer by the end of 2026.

Although Yamaguchi is stepping down from her design role, she will remain with Sanrio to offer guidance and support.

Hello Kitty first appeared on a coin purse in 1974, but it was in 1980 that the character began to gain widespread recognition, eventually becoming a global marketing sensation.

The character has been featured on a wide range of products, including clothing, accessories, video games, and even an Airbus plane, and has partnered with notable brands such as Unicef, Nintendo, and Balenciaga, as well as making an appearance as a float in the Macy's Thanksgiving Day Parade.

Hello Kitty-themed cafes can be found worldwide, and there is a dedicated theme park in Japan, with another park slated to open in China.

Unlike other popular Japanese exports, such as Pokemon, Hello Kitty has a relatively minimal backstory, with Sanrio describing her as "not quite a cat, but not a human either".

According to Sanrio, Hello Kitty was born in London, has a twin sister named Mimmy, and a boyfriend named Dear Daniel, although these details are not widely emphasized in the character's marketing.

A Warner Bros film featuring Hello Kitty is scheduled for release in 2028, marking the character's cinematic debut, although she has previously appeared in several animated series, always without speaking, due to her design lacking a mouth.

-

News13 hours ago

News13 hours agoAustralian Politics Faces Questions Over Gender Equality Amid Sussan Ley’s Appointment

-

News11 hours ago

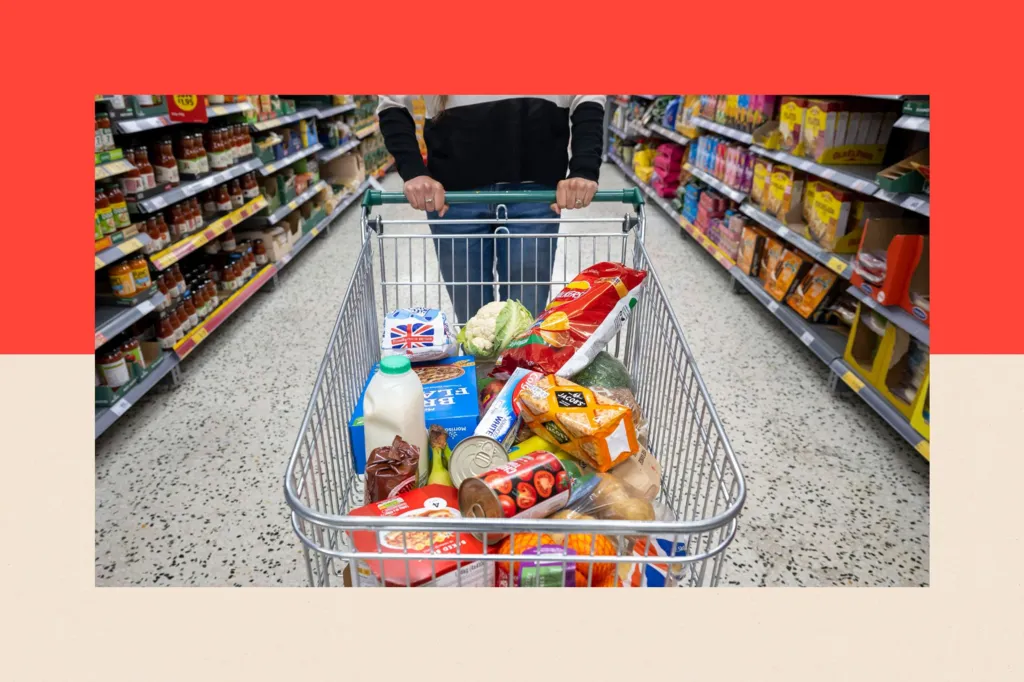

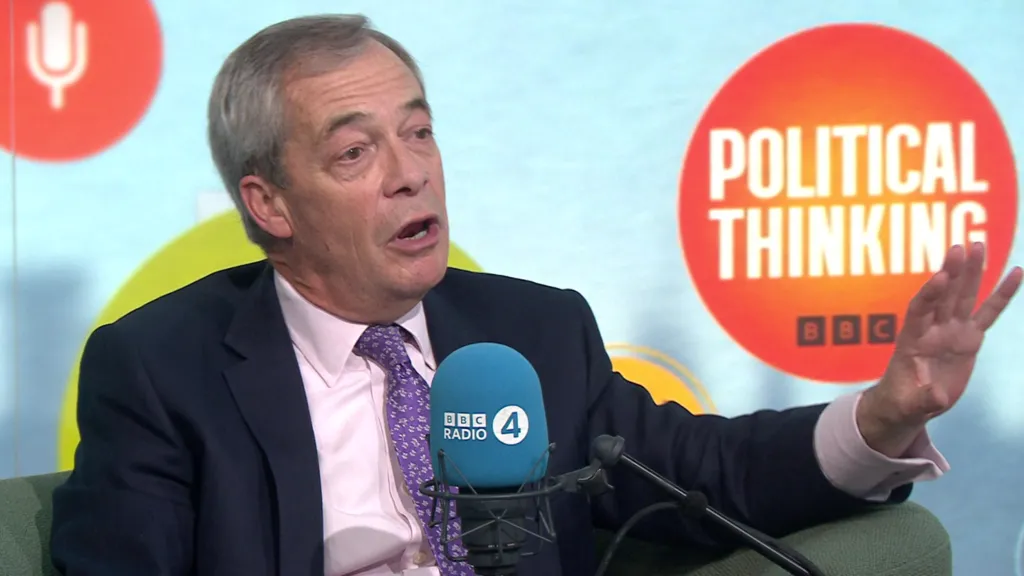

News11 hours agoFarage Says Reform to Replace Traditional Tory Party

-

News11 hours ago

News11 hours agoWrexham Pair Seek Win Against Former Team Ipswich

-

News16 hours ago

News16 hours agoLiberal Party Removes Australia’s First Female Leader

-

News14 hours ago

News14 hours agoUK Braces for Cold Snap with Snow and Ice Alerts Expected

-

News11 hours ago

News11 hours agoHusband’s alleged £600k theft for sex and antiques blamed on drug side effects

-

News2 days ago

News2 days agoSunbed ads spreading harmful misinformation to young people

-

Business16 hours ago

Business16 hours agoBBC Reporter Exposed to Cyber Attack Due to Vulnerabilities in AI Coding Tool