News

Valentine’s Day in Kenya Sees Cash Replacing Traditional Flowers

In Kenya, the practice of giving bouquets of cash as gifts has gained significant traction, but recent cautions may potentially curb its growing popularity.

In Nairobi, the Kenyan capital, a distinctive red hue has dominated the city's landscape every 14 February for as long as many residents can recall, a tradition that has become an integral part of the city's culture.

As people commemorate Valentine's Day, the streets are filled with individuals donning red attire or carrying red roses, embracing the symbolic color of love and romance.

Local traders capitalize on the demand for fresh flowers, leveraging Kenya's position as a leading global producer of cut flowers to offer an array of blooms to customers.

However, a newer trend has emerged, with some individuals opting for bouquets composed of folded, rolled, or fastened banknotes in various colors, rather than traditional flowers.

This phenomenon has spread to other African nations, prompting central banks in Kenya, Uganda, Rwanda, Botswana, and Namibia to issue public warnings about the potential consequences of damaging or defacing banknotes in the process of creating these cash bouquets.

The central banks have cautioned against practices that involve gluing, taping, stapling, or pinning banknotes together, which can render them unusable.

According to the Central Bank of Kenya, banknotes are often subjected to various forms of damage, including being glued, taped, or stapled, which can compromise their integrity.

Damaged banknotes can be rejected by automated teller machines and cash-sorting equipment, resulting in significant costs to taxpayers as they are removed from circulation.

While the Central Bank of Kenya does not object to the practice of gifting cash, it has emphasized that damaging banknotes is a serious offense that can lead to imprisonment for up to seven years.

The popularity of cash bouquets can be attributed, in part, to celebrities and online influencers who often share videos of themselves presenting these unique gifts to their followers.

The demand for cash bouquets extends beyond Valentine's Day, with people also using them to celebrate birthdays and other special occasions throughout the year.

These bouquets come in a variety of designs, with creators tailoring their arrangements to suit the preferences and budgets of individual clients.

The amounts used in these bouquets can range from as little as 1,000 shillings ($8; £6) to as much as a million shillings, according to Angela Muthoni, a florist at the Gift and Flowers shop in central Nairobi.

Cash bouquets can be presented in various forms, including floral designs, combinations of flowers and money, elegant wrappings, cake designs, or gift boxes.

Muthoni reports that money bouquets have gained significant popularity over the past two years, with her shop receiving between 15 and 20 orders daily in the lead-up to Valentine's Day, despite the Central Bank's warning.

Muthoni notes that gifting cash eliminates the stress of choosing a present, as "everyone loves money," making it a convenient and appreciated gift.

Some Kenyans argue that the trend of giving money bouquets reflects a growing emphasis on materialism, where people seek to purchase love and affection rather than cultivating meaningful relationships.

Haskell Austin, a 24-year-old, attributes the phenomenon to peer pressure, preferring to give flowers as a more thoughtful and personal gesture.

Austin describes the idea of gifting money as "materialistic" and suggests that, if cash must be given, a straightforward transfer is a more practical and respectful approach.

Instead of creating elaborate bouquets, Austin recommends simply transferring funds, which he believes is a more considerate and efficient way to show appreciation.

Lynn, who wished to remain anonymous, expressed disappointment at the timing of the Central Bank's warning, as she had been looking forward to receiving a cash bouquet on Valentine's Day.

Despite the warning, Lynn notes that people remain enthusiastic about the trend, with many still eager to give and receive cash bouquets.

Nicole Rono, another resident, shares Lynn's sentiment, stating that she would prefer to receive cash, as "who doesn't love money?" and noting that flowers, while nice, are not as practical or desirable.

Benjamin Nambwaya, a university student, observes that the culture of giving money bouquets is often driven by social expectations, with women typically being the recipients.

Nambwaya believes that this trend can have negative consequences, potentially "destroying relationships" by creating unrealistic expectations and pressures to provide financial gifts.

Nambwaya prefers giving flowers, which he considers a more thoughtful and romantic gesture, allowing him to express his feelings without the burden of financial expectations.

In his view, flowers are a more appropriate way to show appreciation and affection, as they represent a small, meaningful gesture rather than a grand, expensive display.

According to economic expert Odhiambo Ramogi, the popularity of cash bouquets reflects a broader cultural shift towards a more capitalistic approach to life, where special occasions like Valentine's Day are seen as opportunities for commercialization and marketing.

Ramogi argues that this trend is driven by the influence of advertising and marketing, which often emphasizes the importance of material gifts and displays of wealth on special occasions.

For Muthoni, the decision to give cash or flowers ultimately depends on the individual's preferences and values, as people have different ways of expressing love and appreciation.

Muthoni acknowledges that, while some people may prefer more traditional or sentimental gifts, others may view money as a more practical and desirable option, as it can be used to purchase a wide range of goods and services.

In her view, the key to a successful gift is understanding the recipient's needs and preferences, and tailoring the gift accordingly, whether it be cash, flowers, or something else entirely.

The Central Bank's warning has sparked a wide range of reactions on social media, with some people praising the move as a necessary measure to prevent the damage of banknotes, while others have ridiculed it or expressed disappointment.

The debate has also inspired humorous responses, such as memes featuring bouquets made from rolled chapati bread, highlighting the creative and often humorous ways that people are responding to the trend.

On TikTok, Kenyan Scott Ian Obaro noted that the trend may have contributed to a culture of "showing off," where people feel pressure to display their wealth and status through elaborate gifts and displays.

Ramogi suggests that the preference for cash over flowers in African cultures may be due to the fact that giving flowers is a relatively foreign concept, and that many people in Kenya and other African countries would prefer to receive money as a practical way to address their needs.

According to Ramogi, the tradition of giving flowers is a Western custom that has not been widely adopted in Africa, where people often prioritize more practical and tangible gifts, such as money or other forms of material support.

Ramogi believes that the combination of this cultural preference with the growing emphasis on materialism has led to the rise of cash bouquets, where people use banknotes as a symbol of love and appreciation, rather than traditional flowers.

The intervention by Kenya's regulator, along with those in other countries, may help to slow the growth of the cash bouquet trend, as people become more aware of the potential consequences of damaging banknotes.

Muthoni is concerned that the move could have a negative impact on the livelihoods of people who have built businesses around creating cash bouquets, but she remains optimistic that there is room for innovation and adaptation in the industry.

According to her, bouquets featuring transparent pockets that can safely contain money are among her designs, and she is also exploring alternative concepts, including digital arrangements.

In response to the warning from Kenya's central bank, some individuals have opted to use US dollars instead, which would not be subject to the same restrictions.

Given the persistence of this practice, it is unlikely that the tradition of giving money bouquets will be discontinued in the near future.

For additional news and updates from Africa, visit BBCAfrica.com.

Business

Decline of Dining Out Trend Raises Concerns

According to the restaurant industry, it is currently dealing with a dual challenge: increasing expenses and a decrease in consumer spending power.

James Deegan's go-to order at his favorite restaurant, the grilled chicken burger, has lost its appeal due to a significant price hike.

The price increase from £12 to £18, plus the cost of a drink, has made dining out a costly affair for James.

This substantial price jump has led to James reducing his restaurant visits to just a couple of times a month, as he can no longer afford to dine out as frequently as he used to.

As a 27-year-old carer for autistic individuals, James must closely monitor his expenses to cover all his outgoings, limiting his social activities in the process.

James emphasizes the need to budget for small pleasures, which he once took for granted, in order to make ends meet.

The UK's cost of living crisis has been well-documented, with James having relied on a food bank in the past when his finances were strained, and one of its effects is a decrease in people's disposable income.

This reduction in disposable income means people have less money to spend on social activities, such as vacations, drinks at the pub, or eating out at restaurants.

The hospitality industry is facing a significant challenge due to decreased consumer spending and rising business costs, including taxes, food, wages, and energy expenses.

Many restaurants have increased their prices to remain operational, but some have still been forced to close down.

According to the Hospitality Market Monitor, the number of restaurants in the UK decreased by nearly a fifth between December 2019 and December 2025, from 43,000 to 35,500.

A YouGov report found that people in Britain are dining out less frequently, with the majority citing price increases and the rising cost of living as the primary reasons.

The report, published in October, surveyed 2,000 respondents, with 38% stating they were eating out less often than the previous year.

Of those who reported eating out less, 63% attributed it to price increases, while 62% cited the increased cost of living.

Petrit Velaj, a 30-year veteran of the restaurant industry, opened his own Greek restaurant, Rozafa, in central Manchester in 2010.

Rozafa has received awards for its cuisine and has hosted famous diners, including Priscilla Presley and Boris Johnson.

Petrit, who hails from Corfu, enjoys sharing traditional Greek culture and music with his customers, in addition to serving authentic Greek dishes.

However, he is uncertain about the restaurant's future prospects.

Petrit expressed his passion for cooking and providing excellent service, stating that it brings him joy to see customers happy.

He explained that for every £100 the restaurant earns, approximately £55 goes towards paying various taxes, leaving £45 to cover other expenses.

These expenses, including gas, electricity, water, rent, food, and wages, have increased over the years, making it challenging for the restaurant to operate.

As the owner of two restaurants, including one in Stockport, Petrit is responsible for 18 employees, some of whom have been with him for 20 years.

He is aware of the financial burdens his staff face and sometimes forgoes his own salary to ensure they are paid.

Fortunately, Petrit's children are now financially independent, alleviating some of his concerns.

He believes that running a restaurant has become increasingly difficult since he started in the industry.

Petrit, like many chefs, is critical of National Insurance rises and increasing business rates, as well as local issues such as limited parking and unclean streets, which deter customers.

Celebrity chef Gordon Ramsay shares Petrit's concerns about tax, warning that restaurants are "facing a bloodbath" and advocating for more cautious implementation of business rate increases.

Shortly after Ramsay's comments, the government announced a support package for pubs, but not restaurants.

Chancellor Rachel Reeves expressed particular concern about the impact of business rates on pubs compared to other high street businesses.

Petrit fears the potential closure of Rozafa, not only for himself and his staff but also for the local community it serves.

Several well-known restaurants in Manchester city centre, including TNQ Restaurant & Bar, have closed down in the past year.

Petrit believes that restaurants play a vital role in society, providing a space for people to come together and experience different cultures.

Kate Nicholls, chairwoman of the UK Hospitality trade body, agrees that restaurants are essential to the cultural and economic well-being of British towns and cities.

Nicholls emphasizes the importance of restaurants in creating jobs and attracting people to high streets, which in turn benefits other local businesses.

She stresses that restaurants are valuable assets that must be supported to prevent their loss.

Nicholls warns that if restaurants are not utilized, they will be lost, highlighting the need for community support.

Even individuals with above-average disposable incomes are feeling the effects of the higher cost of living, leading to changes in their dining habits.

Vicki Broadbent, a children's author and parenting blogger, comes from a family of restaurateurs and values the importance of restaurants in bringing people together.

Vicki and her husband, who live in Harrogate with their three children, typically dine out once a week, which they consider a privilege.

For Vicki, dining out is not only about enjoying good food but also about spending quality time with her family and reconnecting after a busy schedule.

However, as a higher rate taxpayer, Vicki and her husband are also feeling the financial strain and have adapted their restaurant habits accordingly.

Vicki notes that she and her family have stopped ordering starters due to their high cost, with prices ranging from £7-9 per dish, which could be better spent on a more substantial main course.

The expense of dining out is further compounded by Vicki's two teenage boys, who have outgrown the children's menu and now require more substantial portions, driving up the overall cost of their meals.

To keep costs in check, Vicki and her husband typically opt for soft drinks and water instead of alcoholic beverages, reserving the latter for special occasions such as birthdays or anniversaries.

In an effort to save money, the Broadbents sometimes choose to order takeaways instead of eating out, although Vicki observes that portion sizes have decreased over time, making it challenging to find good value.

Vicki remarks that the value of takeaways is often short-lived, as her teenagers tend to feel hungry again just a few hours later, leading her to question the worth of spending £100 on a meal that does not provide long-lasting satisfaction.

When selecting a restaurant, Vicki is often swayed by establishments that offer discounts, a strategy that Sarika Rana, head of consumer research at YouGov, says is common among many diners.

According to YouGov's October report, the rising cost of living is significantly influencing people's dining habits, with many still valuing the experience of eating out but being forced to make adjustments due to financial constraints.

The report found that half of the surveyed diners had altered their behavior to save money, with strategies including choosing less expensive restaurants and reducing the number of dishes ordered, while 46% of respondents said they forego desserts altogether.

In Crewe, James is being mindful of his expenses, recognizing that careful budgeting is necessary to enjoy a meal with friends or family without breaking the bank.

For James, eating out serves as a vital way to unwind and recharge after periods of intense care work, but he wishes that indulging in such small pleasures did not require so much financial planning and effort.

James expresses frustration at the difficulty of affording modest luxuries like dining out, describing the situation as "crazy" and "ridiculous".

News

UK Courts Overturn Palestine Action Ban, Matt Wins Olympic Gold

Several newspapers feature a picture of Matt Weston, the skeleton athlete who secured Team GB’s inaugural medal at the 2026 Winter Olympics on Friday evening.

To receive a daily newsletter with updates from BBC News, consider subscribing to our morning email service.

News

Bhatia and Hisatsune Take the Lead, McIlroy Faces Uphill Battle

At the AT&T Pebble Beach Pro-Am, Akshay Bhatia carded a 64, eight under par, to move into a tie for second-round lead with Ryo Hisatsune, both players sitting at 15 under.

Rory McIlroy trails the leaders by six strokes as the tournament heads into the weekend, following a second round that saw him card a 67.

The current standings at the AT&T Pebble Beach Pro-Am after round two are as follows:

A Bhatia (US) and R Hisatsune (Jap) are tied at the top with a score of -15, while R Fowler (US) and S Burns (US) are one stroke back at -14, and MW Lee (Aus), S Straka (Aut), and J Bridgeman (US) are at -12.

Other notable players include M Fitzpatrick (Eng), K Bradley (US), H Matsuyama (Jap), J Spieth (US), and X Schauffele (US) at -10, T Fleetwood (Eng) and R McIlroy (NI) at -9, S Lowry (Ire) at -8, S Scheffler (US) at -6, and J Rose (Eng), H Hall (Eng), and R MacIntyre (Sco) at -5.

Akshay Bhatia's impressive eight-under-par 64 has earned him a share of the lead with Ryo Hisatsune, both sitting at 15 under par.

Defending champion Rory McIlroy finished his second round with a birdie, signing for a 67, but remains six strokes off the pace.

McIlroy's round was marked by five birdies and an eagle, but he was hindered by bogeys on the 10th and 14th holes, before closing with a strong four on the par-five 18th.

Earlier in the day, Akshay Bhatia had posted one of the top rounds at Spyglass Hill, while Ryo Hisatsune recovered from a mid-round slump to pick up four shots in his final five holes.

Rickie Fowler has moved into a tie for second place alongside Sam Burns, with a score of 14 under, as he seeks his first victory since July 2023.

Sepp Straka of Austria is the highest-placed European player at 12 under, with England's Matt Fitzpatrick two strokes back, alongside a group including Keegan Bradley, Jordan Spieth, and Xander Schauffele.

Tommy Fleetwood of England followed his opening 67 with a 68 to join Rory McIlroy at nine under, while Shane Lowry of Ireland is one stroke behind.

Scottie Scheffler has rejuvenated his chances with a strong stretch of three birdies and an eagle on five holes after the turn, bringing him to six under par.

Justin Rose and Harry Hall of England, along with Scotland's Robert MacIntyre, are currently at five under par, with each player having completed one round at both Pebble Beach and Spyglass Hill.

The remaining rounds will be played exclusively at Pebble Beach, with no 36-hole cut in place at the $20m (£14.7m) PGA Tour event.

-

News22 hours ago

News22 hours agoAustralian Politics Faces Questions Over Gender Equality Amid Sussan Ley’s Appointment

-

News20 hours ago

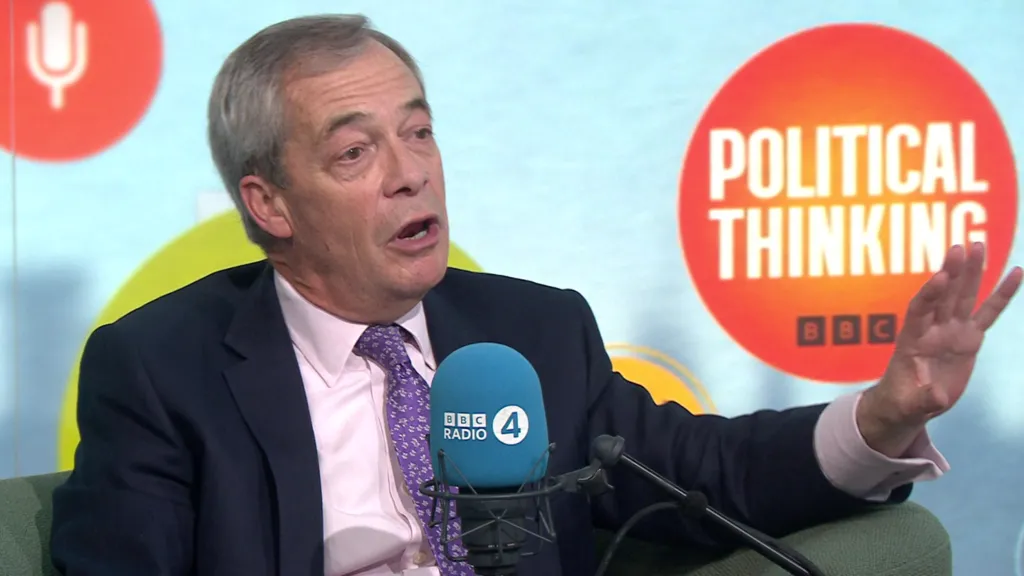

News20 hours agoFarage Says Reform to Replace Traditional Tory Party

-

News20 hours ago

News20 hours agoWrexham Pair Seek Win Against Former Team Ipswich

-

News1 day ago

News1 day agoLiberal Party Removes Australia’s First Female Leader

-

News23 hours ago

News23 hours agoUK Braces for Cold Snap with Snow and Ice Alerts Expected

-

News20 hours ago

News20 hours agoHusband’s alleged £600k theft for sex and antiques blamed on drug side effects

-

News3 days ago

News3 days agoSunbed ads spreading harmful misinformation to young people

-

Business1 day ago

Business1 day agoBBC Reporter Exposed to Cyber Attack Due to Vulnerabilities in AI Coding Tool